The Facts About Bankruptcy Attorney Near Me Tulsa Uncovered

Table of ContentsIndicators on Chapter 13 Bankruptcy Lawyer Tulsa You Need To KnowRumored Buzz on Chapter 13 Bankruptcy Lawyer TulsaAll about Affordable Bankruptcy Lawyer TulsaSee This Report about Chapter 7 Bankruptcy Attorney TulsaThe Only Guide to Experienced Bankruptcy Lawyer Tulsa

The statistics for the other main kind, Chapter 13, are also worse for pro se filers. Suffice it to claim, talk with a lawyer or 2 near you that's experienced with bankruptcy law.Numerous attorneys likewise provide free assessments or email Q&A s. Take benefit of that. Ask them if insolvency is without a doubt the ideal option for your circumstance and whether they believe you'll qualify.

Ads by Money. We might be made up if you click this advertisement. Advertisement Since you have actually made a decision insolvency is without a doubt the right training course of action and you hopefully cleared it with an attorney you'll need to start on the paperwork. Before you study all the official bankruptcy types, you must obtain your own papers in order.

10 Simple Techniques For Tulsa Bankruptcy Consultation

Later down the line, you'll really need to show that by divulging all kind of info concerning your financial events. Here's a basic checklist of what you'll need when traveling ahead: Determining files like your driver's license and Social Safety card Tax returns (up to the past 4 years) Evidence of income (pay stubs, W-2s, independent earnings, earnings from possessions along with any revenue from government advantages) Financial institution statements and/or pension declarations Proof of value of your properties, such as lorry and property assessment.

You'll desire to comprehend what type of debt you're attempting to deal with.

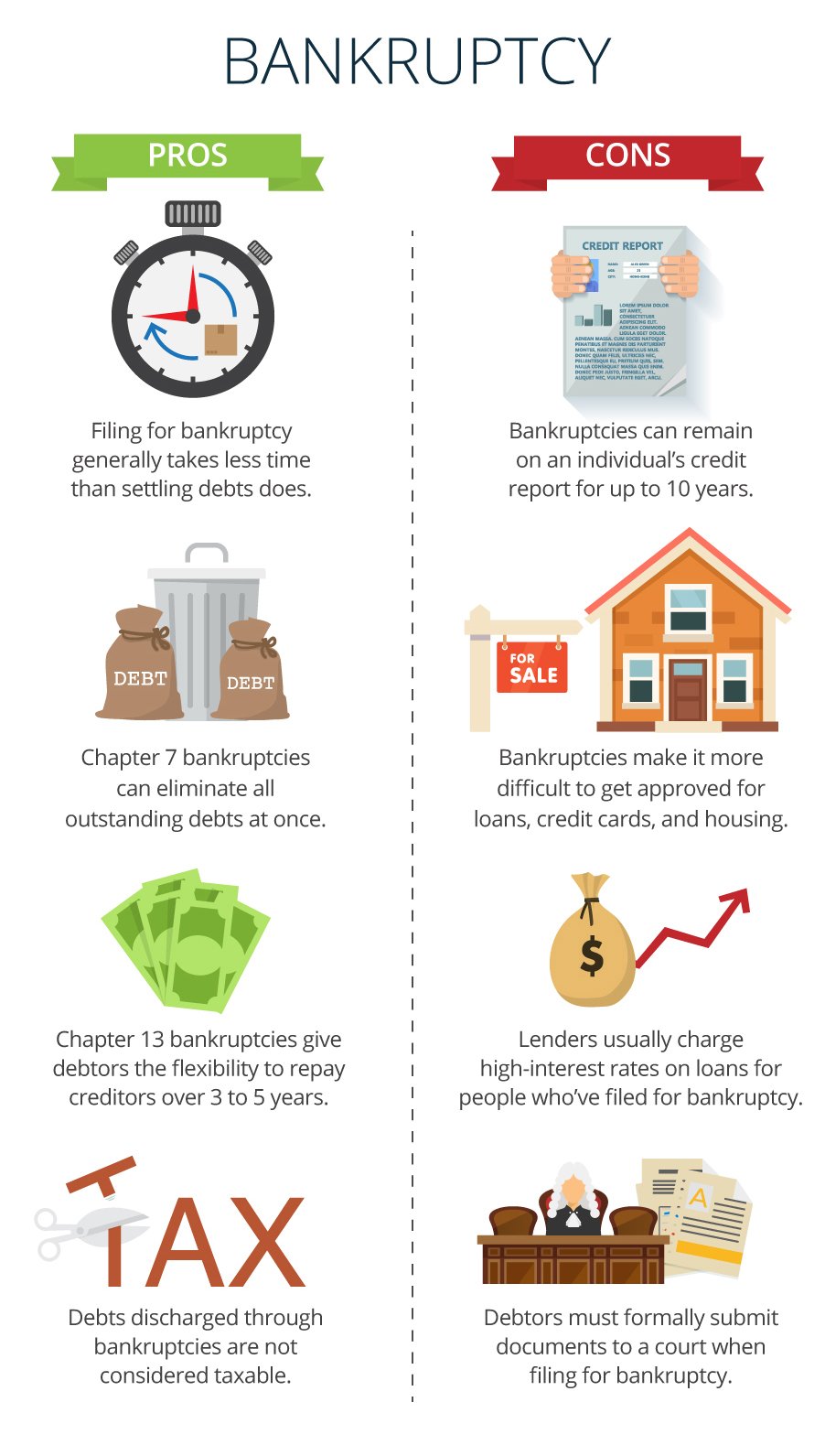

You'll desire to comprehend what type of debt you're attempting to deal with.If your income is too expensive, you have one more option: Phase 13. This alternative takes longer to settle your financial debts since it requires a long-lasting settlement plan usually 3 to five years before a few of your continuing to be financial debts are wiped away. The filing procedure is also a whole lot extra complicated than Chapter 7.

The Of Tulsa Ok Bankruptcy Specialist

A Phase 7 bankruptcy remains on your credit scores record for one decade, whereas a Chapter 13 insolvency diminishes after 7. Both have enduring influence on your credit history, and any kind of new financial debt you obtain will likely come with greater rate of interest. Before you submit your personal bankruptcy types, you must Tulsa bankruptcy lawyer first complete a mandatory course from a debt counseling agency that has been accepted by the Department of Justice (with the remarkable exemption of filers in Alabama or North Carolina).

The training course can be completed online, personally or over the phone. Courses typically set you back between $15 and $50. You should finish the course within 180 days of declare insolvency (bankruptcy attorney Tulsa). Utilize the Division of Justice's website to find a program. If you stay in Alabama or North Carolina, you have to pick and finish a training course from a checklist of separately approved companies in your state.

Not known Details About Experienced Bankruptcy Lawyer Tulsa

Inspect that you're filing with the correct one based on where you live. If your permanent house has actually moved within 180 days of loading, you ought to submit in the district where you lived the better part of that 180-day duration.

How Chapter 7 - Bankruptcy Basics can Save You Time, Stress, and Money.

If you go to danger of repossession and have worn down all various other financial-relief alternatives, after that declaring Phase 13 might postpone the foreclosure and conserve your home. Eventually, you will certainly still require the income to proceed making future mortgage repayments, as well as settling any late settlements throughout your payment plan.

If so, you may be called for to supply added info. The audit could postpone any financial obligation relief by numerous weeks. Certainly, if the audit turns up wrong information, your case might be dismissed. All that stated, these are relatively unusual circumstances. That bankruptcy attorney Tulsa you made it this far in the procedure is a respectable sign at the very least several of your financial debts are qualified for discharge.

Comments on “The Best Guide To Tulsa Bankruptcy Lawyer”